Cubefunder’s Digital Loan Management PlatformTransforming Fintech Lending: A Custom Loan Management Platform with Ongoing SupportCubefunder ‑ an FCA‑authorised SME fintech lender offering flexible loans (£5,000 ‑ £100,000) to UK small and medium businesses.

Business CaseBusiness Case

Cubefunder faced several business and operational challenges that hinder growth and customer satisfaction.

- Manual Processes: Much of the loan origination and underwriting process was manual, leading to delays, errors, and inefficiencies.

- Data Silos: Customer data was spread across various systems, making it difficult for teams to access accurate, real-time information and offer personalized services.

- Limited Loan Flexibility: Cubefunder lacked the ability to easily customize loan terms and repayment schedules to meet the specific needs of diverse borrowers.

- Customer Communication Gaps: Customer communications are often inconsistent and require significant manual effort, leading to missed opportunities for engagement and support.

- Scaling Challenges: As Cubefunder grows, the current systems are not equipped to manage larger loan volumes or provide consistent service quality across regions.

Our solutionOur solution

- Discovery and Requirements: Conducted on-site collaboration to document existing workflows and identify pain points, with clearly defined objectives including process automation, enhanced analytical insights, and improved customer transparency.

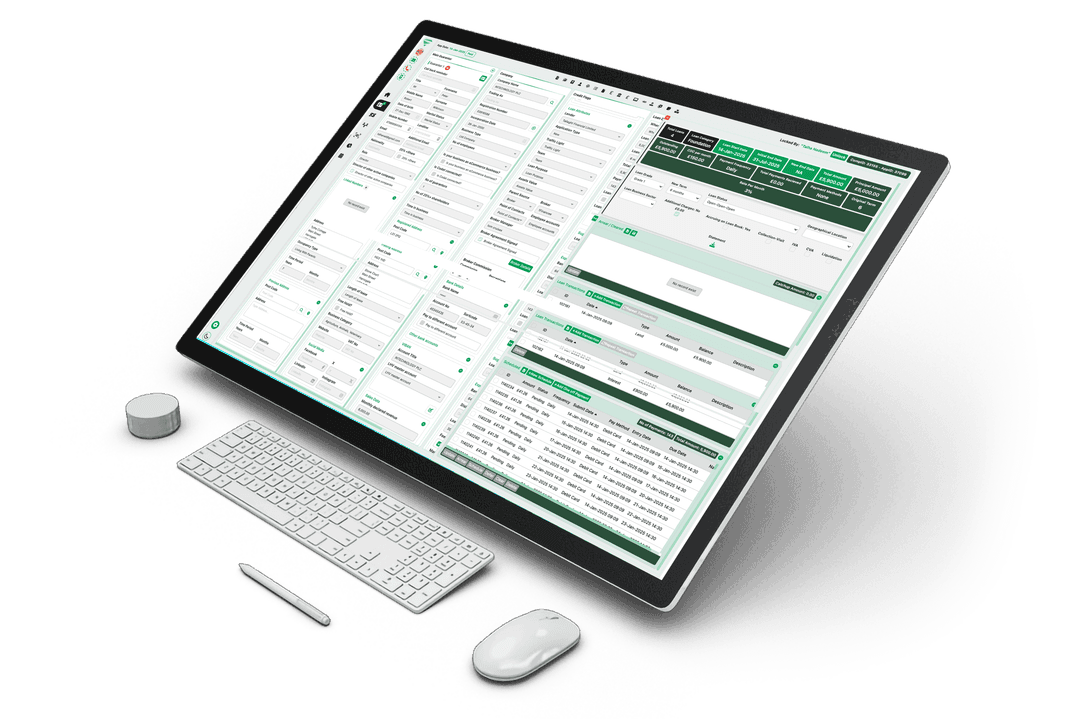

- Design and Architecture: Designed a structured, scalable cloud-based architecture to support multi-product and multi-market expansion, along with intuitive user interfaces including agent dashboards, underwriter tools, and a borrower portal.

- Development: We developed a fully automated loan origination and underwriting system integrated with credit bureau data and custom rule sets to accelerate approvals. A real-time risk analytics module monitors loan performance and flags potential defaults. The solution includes a configurable loan engine supporting flexible repayment schedules, currencies, and terms, along with a secure borrower portal for self-service tracking, statements, and payments. Automated SMS/email reminders and integrated payment gateways ensure seamless communication and efficient transaction processing.

- QA, Deployment and Training: We conducted rigorous testing followed by an alpha rollout to ensure stability and performance. Comprehensive training sessions were provided to equip the internal team with hands-on system knowledge. Post-deployment, we continue to offer ongoing maintenance, dedicated support, and iterative enhancements to align the platform with evolving business needs.

ResultsResults

- 60% reduction in processing time, from application to funding.

- Improved accuracy, reducing manual input and errors.

- Flexible lending terms, enabling bespoke solutions

- Enhanced borrower satisfaction, driven by transparency and speed

- Optimised scalability - capable of supporting larger volumes and more complex lender products

Cubefunder continues to benefit from regular updates and maintenance, ensuring the system evolves with their business strategy.

Client Feedback:

Gary Miller-Cheevers

CEO

The team at atombits was responsive, efficient, and professional, and it was clear that they truly cared about the success of our project.

Continuing Partnership and Roadmap:

Our partnership with Cubefunder is ongoing, with continuous support that includes performance tuning, SLA-backed maintenance, and the rollout of new features to enhance system capabilities. Upcoming enhancements focus on integrating open banking, implementing a fraud-detection, and expanding to support multi-currency lending. Looking ahead, the roadmap includes ERP integrations, advanced reporting modules, and the adoption of AI-driven risk prediction to further optimize decision-making and operational efficiency.